Payout Timelines

In this Article we will cover the timelines on payouts made through Seer to your bank account after Stripe has processed them. You can find the reports that cover what transactions make up your payouts and their actual amount in Seer reports. Please refer to our article here:

Payouts and Traceability reports

In this article you will learn about the following:

- What are the payout times?

- What you need to know about your payouts

- A few examples of how this looks

What are the payout times?

When a payment has been made through Seer, Stripe will handle the processing. After it has been cleared, it will be sent from Stripe to your bank account. This is the time it takes to receive your payouts. These times are different for Credit Cards and ACH payments. Let's look at the times:

Credit Cards are on a T+2 timeline. This means that it will start on the date that the card is run and then be processed over two business days. For example, if a card was run on a Thursday, that will be the transaction date (T). It will then process over Friday and Monday, as those are the next two business days, and should be expected to be in your Bank account by Tuesday.

ACH payments are run on a T+4 timeline. Using the same example of a payment made on Thursday, it would then process over Friday, Monday, Tuesday and Wednesday (four business days). This would make the payout available in your account the following Thursday.

An important note to these formulas is that Stripe normally starts the process of moving your funds over to your account the day before it becomes available in your bank account. This means that if the day before or the day of your expected payout is a bank holiday, it will likely add an additional day to your payout time due to your bank not starting processing on their end.

Please Note: Since the processing days after transaction date are in business days, weekend days will not be counted. There is no difference between a payment being made on a Friday afternoon or a Sunday morning because the first processing day would be Monday in either case.

What you need to know about payouts

A couple of items to be aware of for payouts is that both credit card and ACH payments are sent out together when they are ready in the same payout. This means that you will see times where a payout will be larger than what you may be expecting if you are using the collections report to look at this info. An example would be that if $2000 was run in credit cards one day while $3500 had been run from ACH payments a couple days earlier and both had finished their processing on the same date, your payout would be both of these combined for a total of $5500.

This means if your parents make payments with a different methods over a several day period, you will likely have several different payouts coming in over different days after the processing has taken place. This is the default setting Seer uses when you setup your online payments.

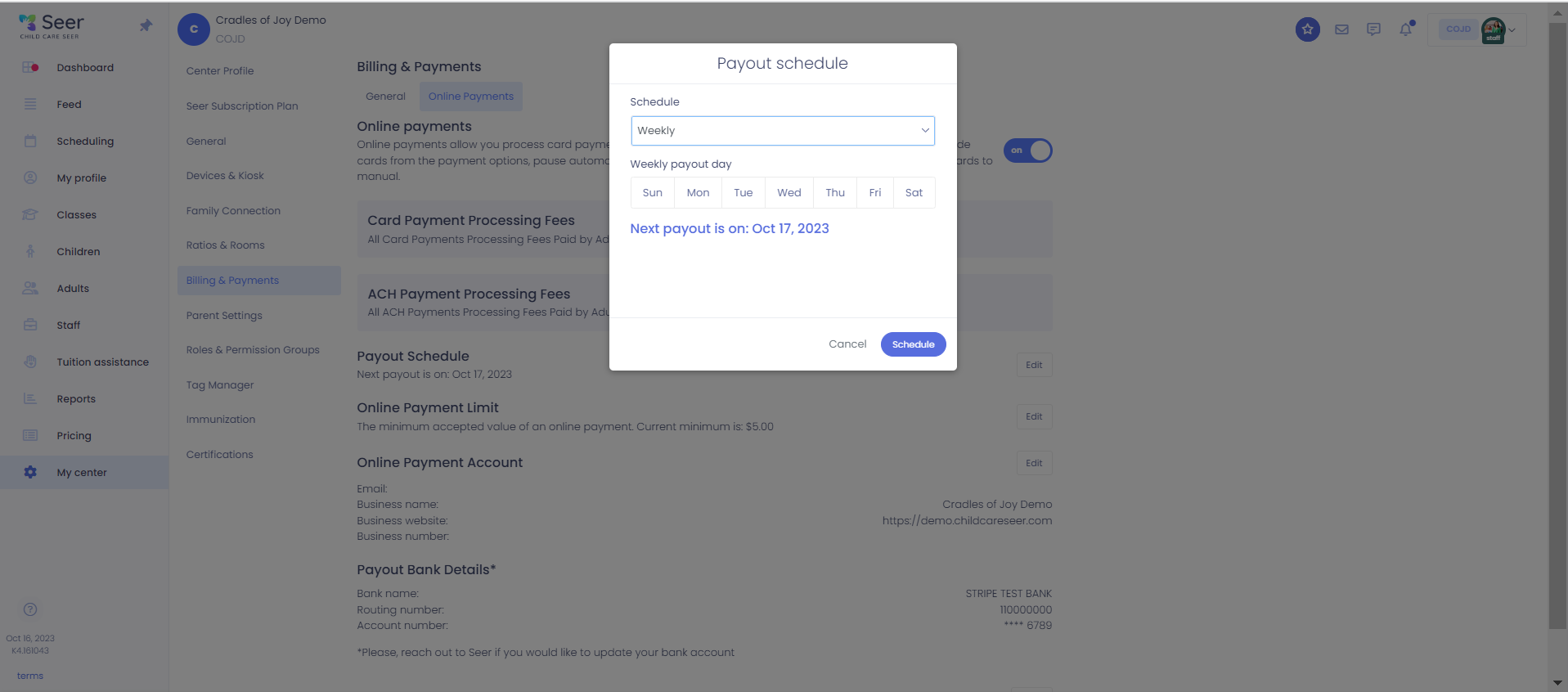

If you wish to receive all your payouts together in one single payout instead of over several days, you may change your payout schedule to something other than the defaulted Daily settings in your My Center Settings. This can be found under the Billing and Payments section. If used, this will withhold all available payments until the new schedule chosen, at which point Stripe will start the movement of the funds on that day. An example would be setting it to a weekly setting and choosing Wednesday as the day of the week. This would hold all available funds until Wednesday each week and then start the transfer, making the funds likely available in your bank account on Thursday.

Lets look at a couple of examples

Example 1:

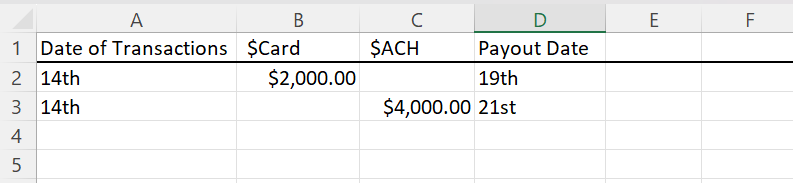

You have $2000 run in payments from Credit Cards on a Thursday the 14th of a given month. You also have $4000 run in ACH payments on the same date. Your payouts will come in two batches from this date since they have the same transaction date while having different processing times.

For the $2000 in credit cards, you should see the money become available in your account on the next Tuesday, the 19th. The $4000 in ACH payments will take an extra two days processing time and will be available in your account on Thursday the 21st.

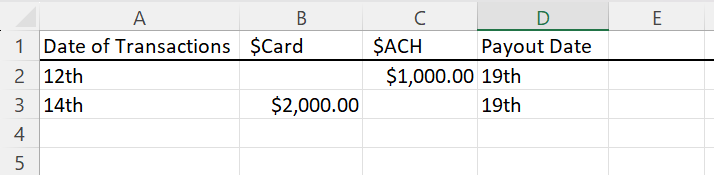

Example 2:

You have $1000 run in Payments using ACH on a Tuesday the 12th of a given month. You then have $2000 run in credit cards on Thursday the 14th of the month. In this case, because both the ACH payments and the credit cards will finish their processing times on the same date, you will see your funds become available for all $3000 on the Tuesday the 19th.

If Monday the 18th was a bank holiday in this example, it would push back your payout date by one day. If that was the case, you would see your funds available in your account on Wednesday the 20th instead.

For our last example we will use a more complex example of different payments over a couple different days:

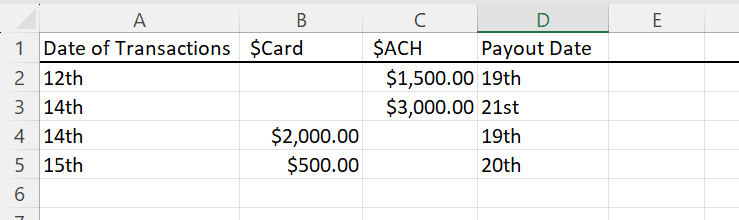

Your center has ACH payments made on a week for the following amounts keeping in mind the T+4 timeline.

$1500 on a Tuesday the 12th

$3000 on a Thursday the 14th

Your center also has Credit Card payments made over this same week using the T+2 timeline as well.

$2000 on Thursday the 14th

$500 on Friday the 15th

In this case you will receive three payouts the following week:

$3500 on Tuesday the 19th from the first date of both the ACH and Credit card payment

$500 on Wednesday the 20th from the second day of Credit Card payments

$3000 on Thursday the 21st from the second day of ACH payments.